- Is it possible given the somewhat random nature of 400oz bars (assuming that is what Germany and Netherlands are getting) that every shipment exactly equals 5.16t or multiples thereof? (I note that the figures are rounded to 2 decimals, so there could be some small variance if it was shown to 3 decimals).

- 5.16t means over 400 bars that every bar is overweight. I haven't had time to check the US Mint bar list (see here and here) to see whether their distributions shows this tendency to overweight.

- Maybe the coin melt or whatever non standard bars Germany and Netherlands are getting are exact weight bars, hence the identical shipment weights?

- If Germany has been doing 5t every month or so, why the rush to do 42t in December? Would it have not been easier to just do a few 10t months and spread the work out.

- Note that in the Bundesbank release they say that "As soon as the gold was removed from the warehouse locations abroad, Bundesbank employees cross-checked the lists of bars belonging to the Bundesbank against the information on the bars removed" so that is a lot of work for December - 3360 bars to check - rather than just 400 or 800 bars per month.

- Why would the need the expertise of the BIS?

- Why do you need to do a "spot check" if Bundesbank employees are cross-checking every bar anyway.

- What was the "spot check" - given point above it isn't a check of the weight and bar number on the bars to the bar list as that is already being done.

- It can't be an assay check as they would have said that explicitly and in any case if anyone should help with that it should be someone from the refinery doing the reprocessing, not the BIS.

- All I can think is it was weighing the bars (that weren't being reprocessed) on a scale to check the weight was correct to the bar or bar list. Do you really need the BIS to help with that?

21 January 2015

German repatriation - trainspotters only

Quite busy at the moment with a few projects deadlining at the same time, hence the lack of posts. This is a quick post which is deliberately trainspotting detail so no critiques I'm ignoring the big issues. Koos notes that:

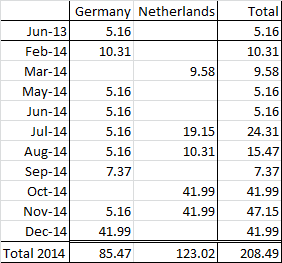

"January till November 2014 the FRBNY was drained for 166 tonnes, if we subtract 123 tonnes The Netherlands got out that leaves 43 tonnes for Germany. The fact Germany claims to have repatriated 85 tonnes from New York in 2014 means they must have pulled 42 tonnes from the Manhattan vaults in December. By the end of this month (January 2015) the FRBNY will release the foreign deposit data of December and we’ll see if the numbers match."

So given the data from FRBNY, how can we construct 123t and 43t (or 85t for the year). I found it interesting that in Koos table 5.16t is repeated three times, that the Feb 2014 10.31t is basically double 5.16t and that the Aug 2014 15.47 is basically 3 times 5.16t. So working from this I get the following breakdown of the FRBNY withdrawals.

I cannot find any other way to get 123t and 85t. I find it very interesting that Nov 2014's 47.15t less 5.16t exactly equals the Oct 2014 41.99t and the balancing shipment for Germany for Dec 2014 has to be 41.99t. This cannot be coincidental. Issues:

Labels:

Repatriation

Subscribe to:

Post Comments (Atom)

The combined July, August and September figures, less 5.16, also equals 41.99

ReplyDeletei.e. [(24.31 + 15.47 + 7.37) - 5.16] = 41.99

Good pick up, there is certainly some standard "lot" size the FRBNY is packing/shipping in.

DeleteIf all was standard lot size, why was some refined and some not?

DeleteThere is also the critical question of how the Bundesbank could have sent 50 tonnes to a refinery for recasting and have it all delivered back to Frankfurt by the end of December, given the fact that Germany only would have only received 43 tonnes from the FRB by the end of November.

ReplyDeleteThis Bundesbank narrative implies that at least 7 tonnes of the recast 50 tonnes was processed by a refinery in December and arrived back Frankfurt by month-end.

This adds to your comment above of why rush things in December. Furthermore, there are significant holiday periods in Europe from 24th Dec to month-end.

7 tonnes is not a lot to re-refine if you are only going up to 9950 purity. Was buba explicit that the re-refine happened in Nov/Dec? Would not the 7.37t in September be the lot that was re-refined?

DeleteIF I was a conspiracy theorist (I am not), I could probably invent the story that the rush to "exit" US is really just a result of the Republicans taking control. Perhaps to appease one of the many conspiracists in their midst, an audit of the US's gold holdings may be slated in the near future. What better way to hide missing gold than to say it has simply been repatriated (even if it wasn't...and other CBs go along with the story...). Anyway, I am bored so thinking this could make a good novel or provide fodder for blogosphere (but I made it up of course!)

ReplyDeleteFrom my Twitter comment:

ReplyDelete1) The FRBNY reports on foreign gold deposits in round Million $ (@42.22/Oz). That makes a margin of 0.37 tonnes on the tonnage we calculate from their reports. It will likely never be exactly 5.16 tonnes

2) DNB reports in % on their gold allocation, that also has a error margin.

Thanks Koos. I did consider the rounding in the % allocations but your point about the FRBNY rounding also gives some wriggle room. Still I don't think there is another combination that produces circa 85 & 123.

DeleteDid the Netherlands give any indication they may have start repatriations in March?

The only thing I heard from a journalist here is that DNB started repatriating in October. So he was wrong. They must have repatriated earlier.

DeleteUkraine gold was around 40 tonnes. Maybe it got routed to Frankfurt instead of NY.

DeleteMaybe the Ukranians wont ask for their gold back too soon.

To Bron and Koos:

ReplyDeletegreat work guys

all the best

harvey