03 December 2014

Gold lease rate curve inversion

Following on from Monday's post on this unhistoric GOFO, I've got around my problems with image upload on blogger by putting it up on twitter first.

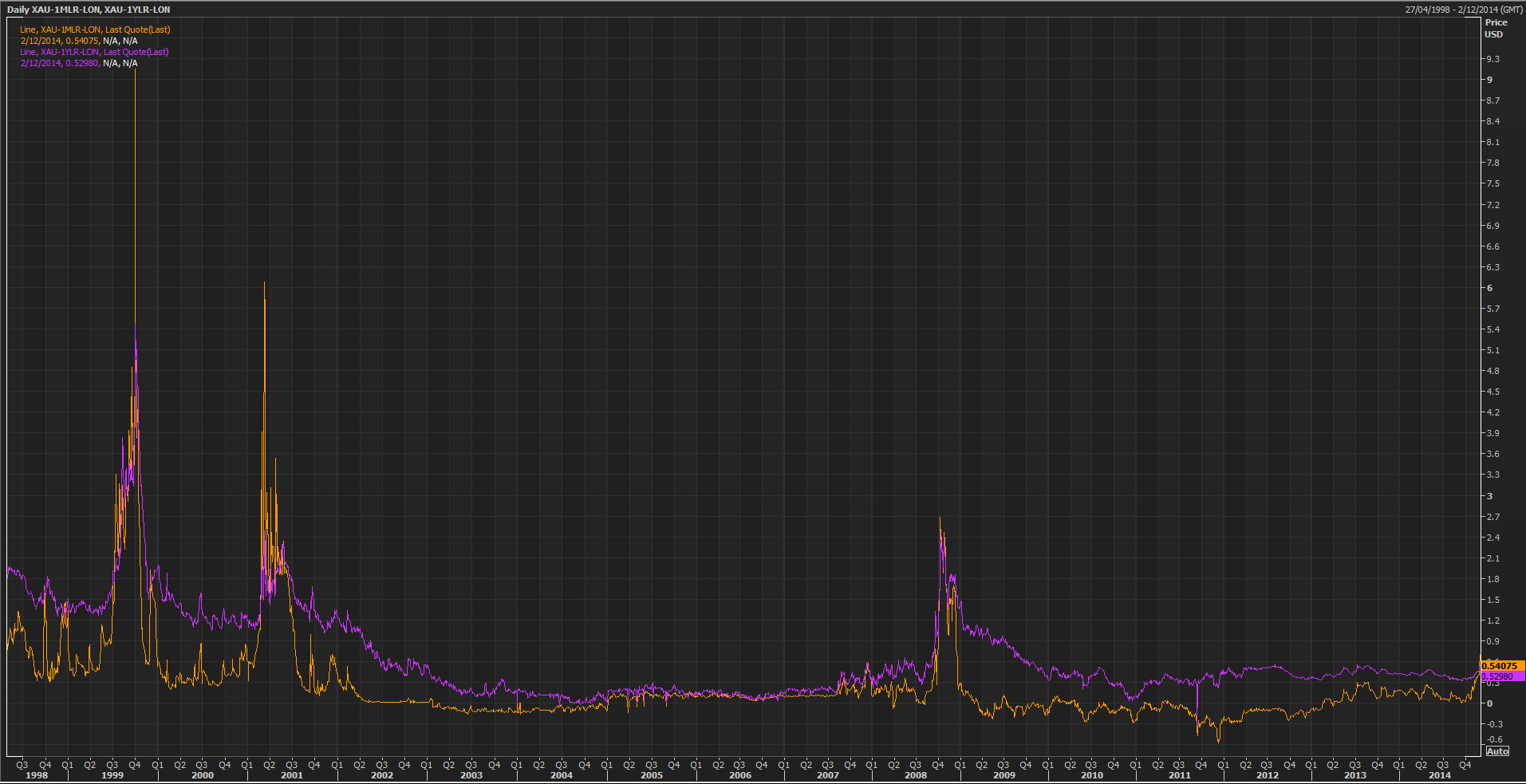

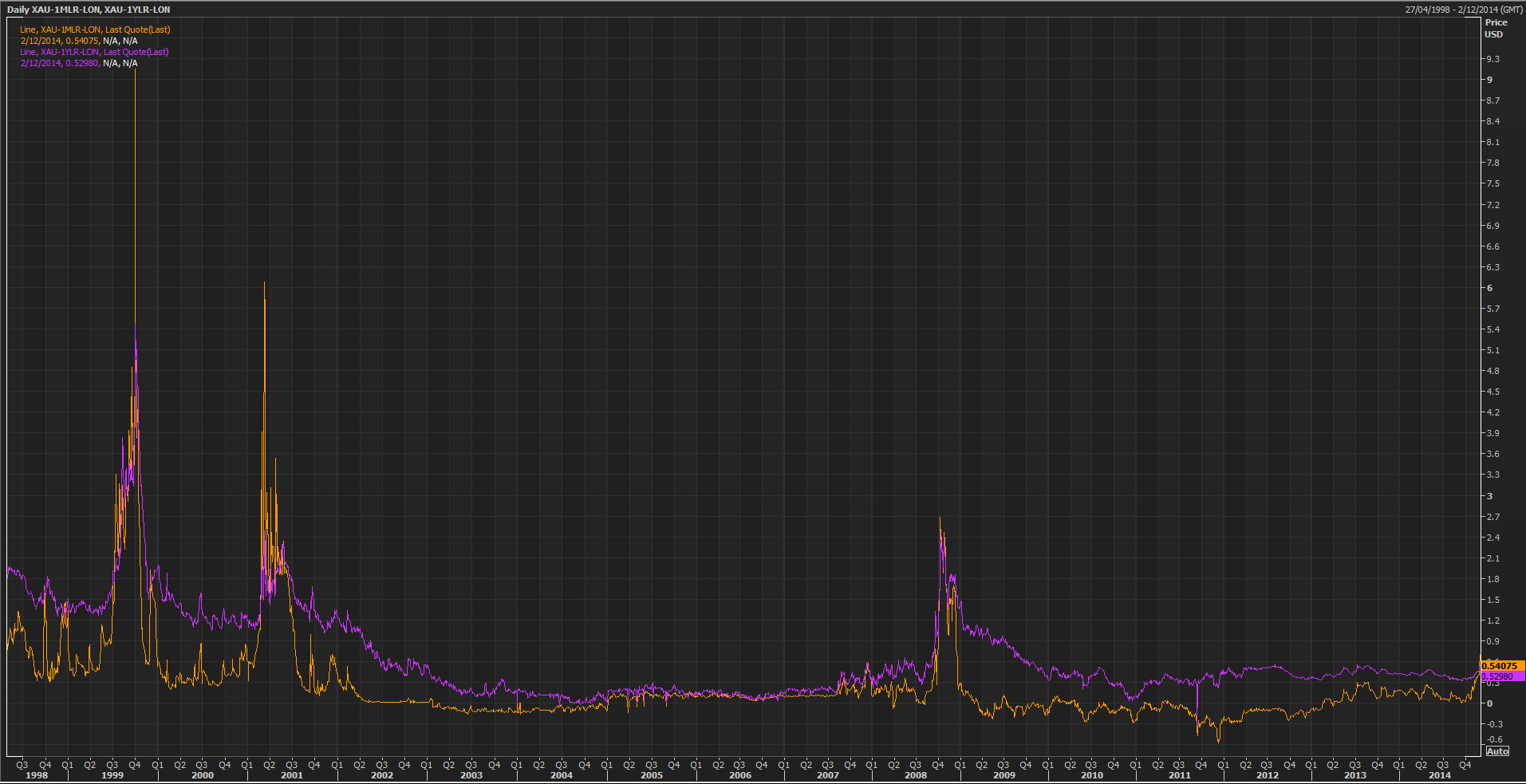

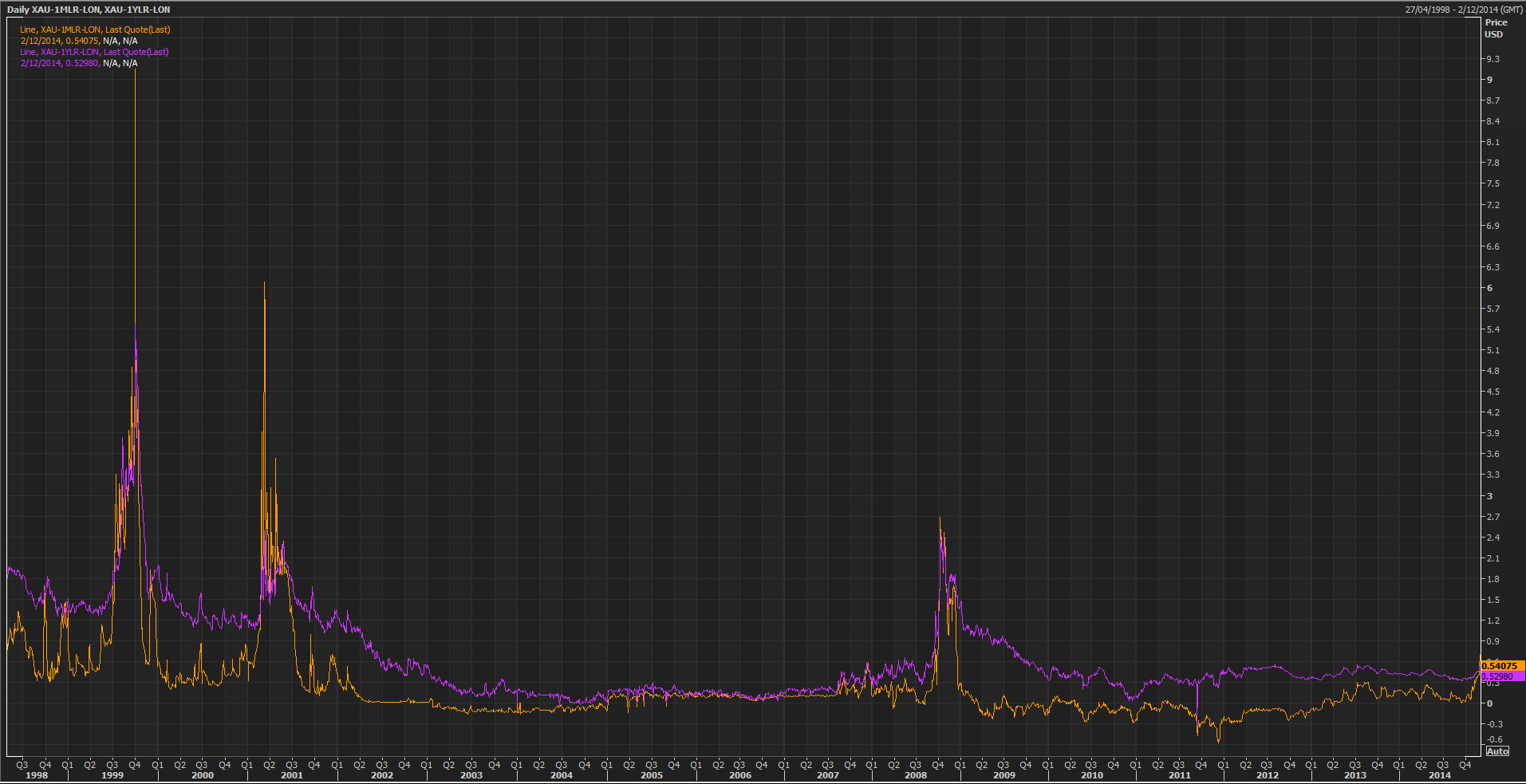

Below is the 1 month and 12 month lease rates back to 1998. I think it is pretty clear that this current situation, while trending in the direction of something historic, is not there yet.

What is interesting is that the gold lease (interest) rate curve has just started to invert, with 1 month rates at 0.54075% while 12 month is at 0.52980%. Such inversions are rare, with the significant occurrences being in 2008, 2001 and 1999.

It is worth noting that during these periods the lease rate spikes lasted for at least 3 months before returning to pre-spike normal lease rates. There is also no correlation with action in the gold price. In 2008 for example, the gold price continued to weaken as lease rates went up during early Q4 2008. In 1999 you can see that the gold price was stable during Q3 1999 all the while lease rate spiked to record highs. So I think it is premature of commentators to spin this high lease rate/negative GOFO as guaranteed indicator of a bottom - history shows that price could weaken further before climbing.

On Monday I gave a number of reasons why we are seeing the action we do. The 2008 experience where the price fell while lease rate were high does suggest shorting. I would note that such shorting action could come from futures markets where speculators see the initial price weakness and then pile in. In such one-sided situations bullion banks will make a market and take the long side and hedge themselves by shorting gold in the OTC spot market. Such shorting activity will result in demand for borrowed gold, hence lease rate rise.

Such a theory means that lease rate spikes (if speculative driven, not liquidity driven) may be indicative of excessive shorting and thus market bottoms. If one saw futures speculative positioning on the short side, bullion banks on the long side and high levels of open interest at the same time as lease rates spiking off recent normal levels, then that could provide strong confirmation of excessive short sentiment.

By the way, Steven Saville has also just blogged on the recent "backwardation", saying much the same as I did on Monday but his post has GOFO and LIBOR charts which show the identical behaviour - worth checking out to see what I was going on about.

Labels:

Backwardation,

Hedging

Subscribe to:

Post Comments (Atom)

I would assume you do not see eye to eye with Fekete's assertion that eventually - not necessarily now - gold will move into a permanent state of backwardation.

ReplyDeleteTwo questions: Why, with the undeniably buoyant physical demand, does the "price" keep falling?

And what exactly is your objection to government, through regulatory agencies, imposing a rule to ensure that each, every and ALL contracts - long or short - are backed 100% by certifiably unencumbered physical bullion deposited with the exchange (or otherwise in escrow) for the duration of said contracts?

Anything else is fraudulent fractional reserve gold.

Fractional reserve BANKING is sometimes claimed legitimate because each depositor to a fractionally-reserved bank is aware that sufficient funds to cover withdrawals of each demand deposit do not exist.

Given the comingling of real metal with paper gold vehicles in the process of price determination, the same cannot be said of fractionally reserved gold.

See here for a view on how permanent backwardation would develop http://goldchat.blogspot.com.au/2010/07/degrees-of-distrust.html

ReplyDeleteI'm not so sure backwardation can be permanent, if one considers that it is just function of cash and gold interest rates and there is no hard rule that one money's interest rate has to be high than another's (except in hyperinflation), see http://goldchat.blogspot.com/2008/12/gold-isnt-in-backwardation-usd-is-in.html and http://goldchat.blogspot.com/2013/09/faux-gold-arbitrage.html

Re futures - and to be fair and also ensure not fraud, longs would need to 100% back their contacts with cash. In which case you no long really have a futures markets but a spot market with future settlement.

I haven't the time to go into the purpose of futures markets (where speculators take on risk that others, usually industry, don't want) and why it therefore needs only fractional margin deposits rather than 100% margin. It would be worth googling the theory of futures.

And as to "undeniably buoyant physical demand" vs "price falling" this recent post by Alex Stanczkhttp://www.rapidtrends.com/2014/12/03/there-is-no-such-thing-as-a-gold-shortage/ deals with this issue.

ReplyDelete"There is no such thing as a “Gold Shortage”

ReplyDeletePosted on December 3, 2014 by Alex Stanczyk"

It warms my heart to read such intelligent commentary.

You never know Bron, but I think the gold community may be growing up at long last.

Nice one, Alex Stanczyk.

Perhaps I should re-phrase.

ReplyDeleteThere certainly IS a "gold shortage" at the present price, a situation that can only become more acute as the years go by because the available metal is gravitating into stronger and stronger (read: Chinese, etc.) hands.

No one can say with any certainty just who wants more metal at the present time or why, though we all have our suspicions. Paper-set "prices" will eventually (when?) be pushed up sharply to satisfy that demand.

Sometimes an excessive reliance on charts, statistics, graphs, rates, waves, quotes from authorities and government-provided numbers obscures simple common sense.

"There certainly IS a "gold shortage" at the present price"

ReplyDeletethis is utter and complete nonsense.

Price is the intersection of supply and demand.

there's a reason the price has been falling, and it's not because of excess demand and a shortage of supply.

Kid, the "price" is *not* *not* set as a result of "supply and demand".

ReplyDeleteIt's set in the paper markets, where "players" bet on "the gold price"...where shorts need hold no gold, where virtually no one intends to take delivery of any actual metal and where a tiny pile of play gold, many times encumbered, is swapped between players in turn on both the way 'up' and 'down'...

Plenty of powerful vested interests want this travesty to continue, too.

"there's a reason the price has been falling, and it's not because of excess demand and a shortage of supply."

ReplyDeleteWhat I'd like to see published by any analyst with the courage, is a bar chart of net bullion imports to the West (UK + Switzerland) versus the East (India + China/HK) since 2001.

Put the West's imports/exports above the X-axis and the East's below it. The chart would clearly explain why price ran up so much then fell after 2011/12.

The large net bullion flow to UK + Switzerland from 2008-12 in particular isn't generally appreciated, flow which has since reversed in a major way.

Bron/All, Interested in thoughts on: 1) The LBMA compression 16-17th December 2014 announced on their web site ?

ReplyDelete2) Is there a bullion bank run happening now like Steve Ellis suggests ?

Thanks

"Is there a bullion bank run happening now like Steve Ellis suggests"

ReplyDeleteNope, Steve Ellis is attempting to promote himself like everyone else does. Sensationalism sells.

If only I had a dollar every time some expert in the last 20 years said a bullion bank run was about to happen, with gold set to moonshot....

Kreditanstalt -

ReplyDeleteevery paper gold contract sold on the COMEX must be closed out or delivered on. When one sells a contract and later buys it back (or vice versa), there is no net supply or demand. This is a fact.

Once you understand this, you'll understand why the memes you've been fed are nonsense.

best of luck - I'm not going to go through Goldbuggery 101 with you in this comment thread.

oh ps: in case you were wondering, there is still no paper/physical price disconnect.

Kid,

ReplyDeleteContracts (BETS!) that are rolled over or closed out in paper currency remain contributories to the setting of the price for the physical metal.

That is fraud...which is my point.

Kreditanstalt

ReplyDeleteso both Buyers and Sellers of futures contracts are defrauding each other - is that the point you are seeking to make?

Or is it only Sellers?

Or only Buyers who aren't good for the full purchase price and simply trade on margin?

Or don't you really understand how (or why) markets operate?

At least one of us is desperately confused

Anonymous gold bear,

ReplyDeleteAgain, tell us why - despite incontrovertible evidence of a physical demand tightness - does the " gold price" keep dropping...?

It's true that "the price" is manipulated both up and down - in recent months generally down. We ALL know that...that's how the punters make their money.

But no one can provide any commonsense justification as to WHY these paper bettors should even have the ability to influence the price of the physical metal at all.

One must either support the present system or oppose it in the end.

1) The LBMA compression 16-17th December 2014 announced on their web site?

ReplyDeleteDon't know what you are referring to, do you have a link?

2) Is there a bullion bank run happening now like Steve Ellis suggests?

Not that I'm aware of, Perth Mint doesn't see bullion banks bidding for 400oz bars. We've seen lease rates go a lot higher than they are now and the fraction reserve bullion banking system did not fail.

http://www.lbma.org.uk/_blog/lbma_media_centre/post/discontinuation-of-GOFO/

ReplyDeleteDiscontinuation of GOFO wef 30 January 2015

Wednesday, December 03, 2014

The Gold Forward Offered Rate (GOFO) dataset will be discontinued and no longer be published after 30 January, 2015. Gold IRS market participants looking to wind down existing trades, are encouraged to contact TriOptima’s triReduce Team (details below) to sign up to the forthcoming compression cycle to terminate outstanding contracts. All participants will have the opportunity to assess their compression potential at the Dress Rehearsal stage, ahead of Live Execution.

For more information and background on TriOptima,

Live execution: Tuesday, 16 December - Wednesday, 17 December

The stopping of GOFO is no surprise, the data itself was questionable as it was a LIBOR style estimate for what (OTC forwards etc) is a bespoke business so rates are always credit risk dependent. With the regulators wanting extra compliance, I can see how it didn't make sense to spend money to produce a quote that was pretty much a pro bono service.

ReplyDeleteThe "compression" is only for gold interest rate swaps, which have a variable component determined by GOFO on the future date, compared to forwards where the future rates are fixed at time of entering into the transaction. Perth Mint doesn't deal in gold IRS so it is getting out of my area of expertise and I don't have any info on the process mentioned.